Finding external investors as a start up is always hard. Making a strong first impression is crucial for gaining traction with investors who have listened to pitches from hundreds, if not thousands, of qualified entrepreneurs. Unfortunately, many start ups fail to secure external funding due to poor presentation skills and lame pitches.

In this article, we'll explore how to find investors for a start up and why you need donuts.

Wait…donuts?

Let's not keep you guessing. Of course, we don't mean that you should approach investors with these delicious, fried rings in hand.

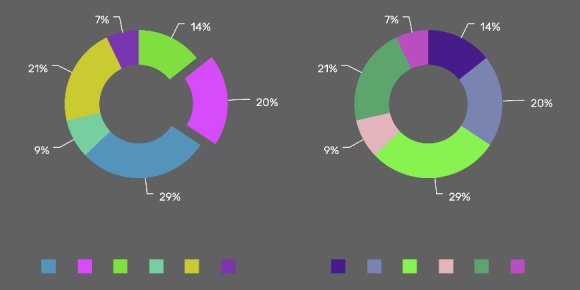

The term donut in start up marketing and funding is often used to describe the circular diagrams that help people visualise numbers.

Approaching investors with informative donut charts is a good way to establish your credibility. Of course, the donut here is figurative - your numbers can be presented in any diagram you want or just articulated in short pitches.

Your purpose should be to create a self-presentation with a solid footing. In other words, containing facts and reliable assessments. If possible, they should be presented visually.

This data-driven method can be referred to as the "donut approach".

What pitches are considered implausible?

Here are some shortcomings that could spoil your attempt to secure start up funding:

- Unclear problem statement. If your pitch fails to clearly define the problem your solution addresses, it becomes difficult for investors to understand the value proposition.

- Lack of market research. Without detailed market research, your pitch will lack credibility. Investors need to see that there is a demand for your product or service.

- Weak business model. A pitch without a strong, sustainable business model is unlikely to convince investors. They need to know how your business will generate revenue and achieve profitability.

- Overly optimistic financial projections. Unrealistic financial forecasts can undermine your pitch's credibility. Investors prefer conservative and achievable projections based on solid assumptions.

- Lack of traction. If you can't demonstrate some level of traction or progress, investors may doubt the feasibility of your project. Evidence of customer interest or early sales can make a big difference.

How to give value to your elevator pitch or cold email?

Engaging "cold" investors who are unfamiliar with you, or your business is a high-level task. To approach such an unprepared audience, start up owners use elevator pitches (short presentations about the business) and cold emails. The primary purpose is to hook an investor and encourage them to continue the discussion.

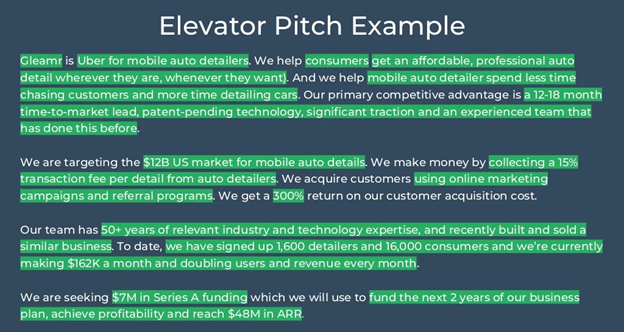

In such a short format, you should avoid any repetitive and non-essential information to focus on the informative part. Here is a structure for an elevator pitch for a start up (this could be applicable to cold emails as well):

- Problem statement. Start with a succinct problem statement. Clearly articulate the issue your product or service addresses.

- Solution. Provide a brief overview of your solution. Explain how your product or service effectively solves the problem you've just highlighted.

- Market and traction. Mention the market's potential. Illustrate the size and growth potential of your target market. Share significant milestones or successes your business has achieved. In other words, present your donut charts – include your key numbers and short statistical facts.

- Team. Briefly mention the team's expertise. Highlight the qualifications and experiences of your core team members. This reassures investors that the business is led by capable individuals who can execute the vision.

- Call to action. End with a clear request. Make a specific request to highlight what you want.

An example of a good elevator pitch for a start up business to accompany your donut charts might be:

source: freepick.com

How to present your start up in an extended presentation

If you get the chance to give a longer presentation to investors, you must give greater detail about your firm while still telling a coherent and interesting story.

Introduction. An engaging tale that exemplifies the issue you're trying to solve should come first. When doing this, you can personalise your pitch to establish a feeling of empathy with your listeners.

Problem statement. Provide a detailed explanation of the problem, supported by data and real-world examples. Make it clear why this problem needs a solution and the impact it has on potential customers. Here's the place where your donut diagrams should be on point.

Solution. Describe your product or service in detail. Highlight its unique features, benefits, and how it addresses the problem effectively. Use visuals and demonstrations to make your solution tangible.

Market analysis. Present comprehensive market research. Talk about your target market, growth patterns, and market size. Utilise statistics to back up your assertions and demonstrate the significant demand for your product.

Business model. Explain how your start up will make money. Detail your revenue streams, pricing strategy , and go-to-market plan. Show that you have a sustainable and scalable business model.

Traction. Share key metrics that demonstrate your start up's progress and potential. This could include user growth, revenue figures, partnerships, and customer testimonials. Highlight significant milestones you've achieved.

Team. Introduce your team members, emphasising their expertise and experience. Demonstrate that your group has the abilities and know-how required to carry out the business strategy and launch the company successfully.

Financials. Provide realistic financial projections. Communicate how you intend to use the investment to meet certain objectives, including your financing requirements, critical financial KPIs, and revenue estimates.

Risks. Don't pretend that you are invincible. Acknowledge potential risks and present strategies to mitigate them. Show that you have considered possible challenges and have plans in place to address them.

Conclusion. Recap the key points of your pitch. Emphasise the reasons why investing in your firm is a good idea. Conclude with a compelling remark that invites investors to continue the discussion.

A final tip

The key to approaching investors is to ensure you come across as trustworthy with excellent prospects so that you convince investors to give you money. Real data and figures help in doing so.

Use donut charts in your start up marketing and funding requests to back up your claims and be sincere in your presentation. This will significantly improve your chances of securing the start up funding you need.

Copyright 2024. Article made possible by Purrweb.